14 January 2020 – Expansión

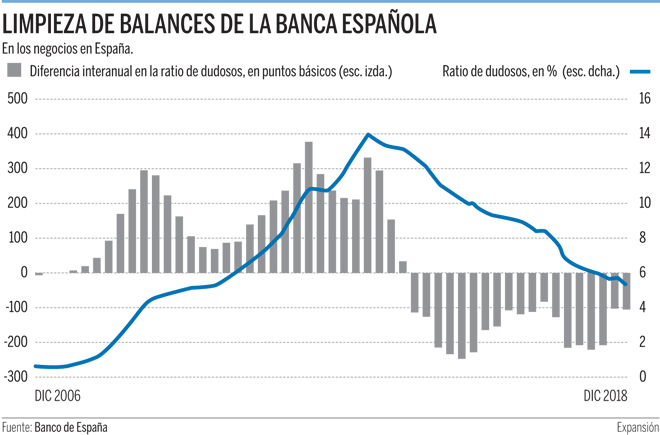

Spain’s large banks are preparing for the mass sale of refinanced mortgage portfolios to opportunistic investment funds over the course of this year, ahead of a European regulatory change that will come into effect from January 2021. The new rules will require most refinanced debt to be classified as non-performing loans, which will impose more onerous capital requirements on the entities holding those assets.

Refinanced mortgages are those whose borrowers are currently up to date with their repayments but whose terms (economic conditions or duration) have been adjusted to avoid defaulted payments.

In the year to September 2019, Spain’s eight listed banks (Santander, BBVA, CaixaBank, Bankia, Sabadell, Bankinter, Unicaja and Liberbank) removed problem loans amounting to almost €37 million from their balance sheets. No detailed figures are compiled about refinanced mortgages, but sources in the sector estimate that a new market worth thousands of millions of euros could be generated as a result of the upcoming legislative change.

According to the new criteria to be introduced by the European Central Bank, refinanced loans will be classified as non-performing if the associated income generated by them falls by more than 1% as a result of the new terms of the loan. With such a strict threshold, almost all such loans will, therefore, be classified as non-performing.

In this context, a new market is expected to emerge whereby the banks try to divest portfolios of refinanced mortgages that are still considered healthy, but at lower prices.

The likely winners will be opportunistic funds, such as Cerberus, Blackstone and Lone Star, which typically buy doubtful assets with average discounts of 70%, and go on to generate double-digit returns through a combination of synergies and economies of scale.

Original story: Expansión (by R. Sampedro)

Translation/Summary: Carmel Drake

Portugal

Portugal  Italy

Italy  Greece

Greece