18 April, Milano Finanza

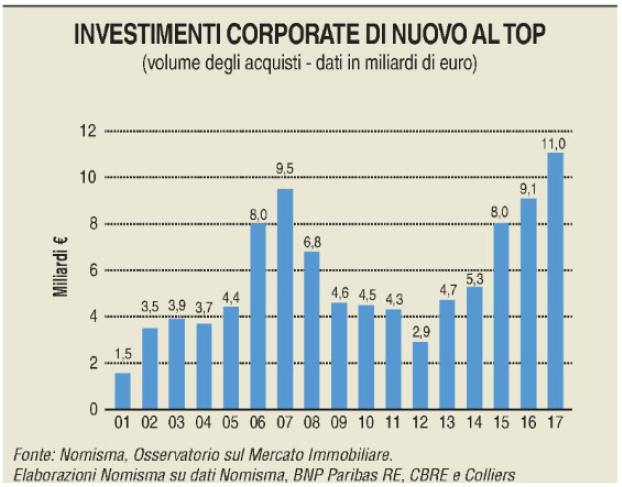

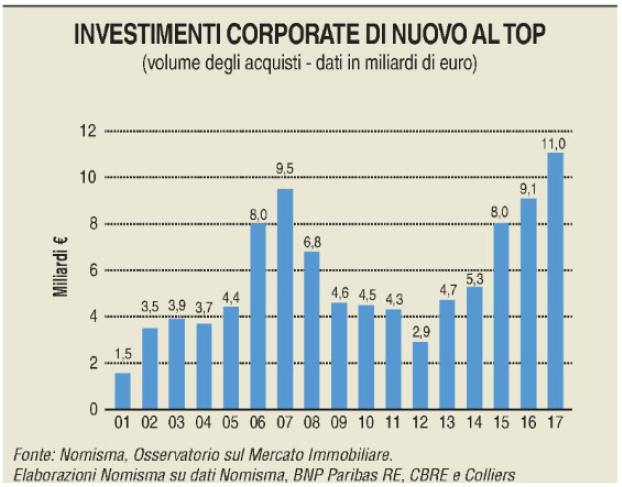

Only the rise of prices is missing. Apart from that, all the other indicators show the good shape of the Italian real estate as they’ve improved in the last three years. Moreover, thanks to the impulse given by international capitals, non-residential investments (offices, commercial spaces, logistics, hotels, assisted living facilities) have registered a new record in the last two years reaching over 11 billion euro and surpassing the pre-crisis figures. Besides transactions, also the other parameters have improved: the demand has grown, even reporting multiple buyers for the same property (for the first time since 2007), the while times to sell and the discounts applied have reduced. Finally, also the rental market is performing well, with the demand growing and stable prices if not increasing, despite the broad offer.

The price issue is certainly not secondary. Not only because is the most evident sign, but also because is a reassuring factor for buyers and investors. This weakness has many reasons that only depending on the current market conditions. Firstly, the Italian real estate didn’t collapse with a 50-70% fall in a very short period of time, like other countries did. In the Italian real estate market (not only residential), prices decreased very slowly and gradually, falling on average by 30-35%, and this trend is not over yet. The lack of a dramatic plummeting of prices (which erased all the excesses) reflected on transactions: the residential transactions were more than halved (from 850 thousand during the highest point to 400 thousand in 2012), while those in the service sector shrank to 2 billion, with very little liquidity and a strict selection. All this is just a bad memory now. Nowadays, what slows down the market is an incomplete economic recovery and not equally spread throughout the country. However, the main weakness is represented by inflation, still at minimum levels, which was the fuel of the real estate market in the past.

Increase of prices in 2019-2020

And now? The question is whether, when and how the market will be able to overcome these limitations and how the future market will look like. According to Nomisma, for a full price recovery, it will take another couple of years: 2019 for residential (+0.4%) which will reach +0.9% in 2020, same for retail (+0.5% and +1% in 2019-2020). Whereas offices will remain stable in next year and they’ll grow by 0.5% in the following year. This outlook considers only the first 12 cities, while for the national average times are even longer. In the meanwhile, the market will get stronger, starting from the most solid cities where prices have resumed growing. These are the centre and semi-centre of Milan and Rome for what concerns residential, and the area of Milan for the other property types. The market is recovering also in Florence, Bologna and Venice.

Rentals or sales. What matters is the quality

The persistent uncertainty regarding prices has changed the attitude of the potential buyers which have become increasingly selective. The past few years showed how the properties that resisted better the recession were the high-quality ones in terms features: well-located, ideally served by the metro system, close to schools, shops and other services, of medium dimensions, in discrete conditions and with good finishing. In addition, spaces have must be smartly distributed, eliminating unnecessary elements such as entrances and long corridors, preferring properties with two bathrooms and a spacious living room. After all, who buys a house to live in long-term wants to make sure that it satisfies his/her needs, whereas who buys with the idea of selling in a couple of years opts for something easy to resell without losing in value. The same is valid for who buys to rent, encouraged by the rise of short-term rentals: only a property with the right characteristics can grant a steady stream of tenants and therefore a good profitability.

The same logic is valid for offices, commercial spaces, hotels and so on. The price of a property is determined more than ever by its features: energy efficiency, environmental sustainability, anti-seismic property, etc… These are the conditions to easily resell the property in the future, taking into account the lease prices in the meanwhile. For instance, in Milan, the profitability for offices doesn’t go above 4% and the highest rental price amounts to 500-550 euro/Sq ma year. Starting from these figures, the property price is calculated. It’s not by chance that in Milan, as in the rest of Italy, it’s easier to sell properties already rented, and it’s more likely to develop an area if this has already a potential tenant with a lease already signed. This is what has recently happened with the Libeskind tower in City Life in Milan -which will be occupied by PwC – along with the other tower nearby launched by Kryalos , the buildings that are going to be developed by Beni Stabili in the south of Milan and will be leased to the insurance company Aon, just to name a few examples.

In conclusion, something is moving again in the market. The investors, especially international ones, are appreciating again Italian real estate, and are ready for action.

Source: Milano Finanza

Translator: Cristina Ambrosi

Portugal

Portugal  Spain

Spain  Greece

Greece