The growth of real estate has slowed down

15 September, Milano Finanza

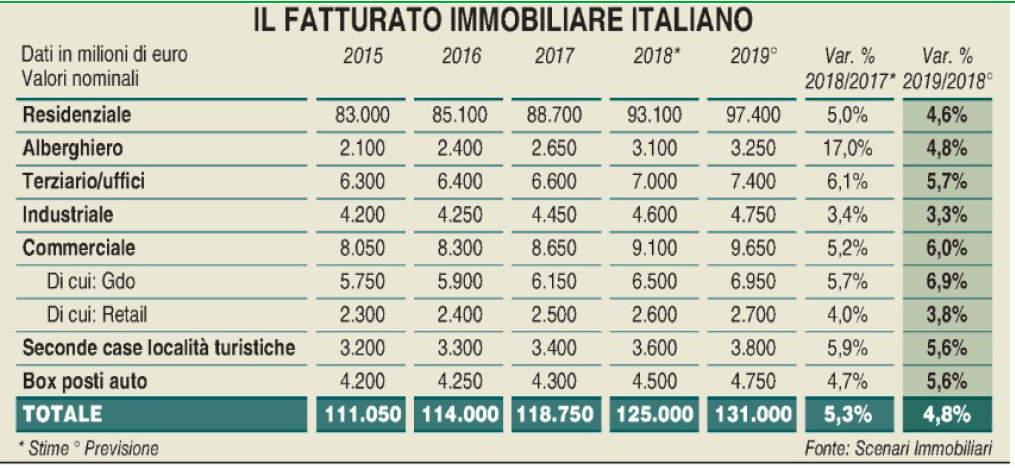

The Italian real estate market continues to grow, but the rest of Europe has done even better, after having closed 2017 with transactions increased by 4.2% from the previous year, the outlook for 2018 is for an additional leap of 5.3% and of 4.8% in the next year. The figures are reported by Scenari Immobiliari, and they show the gap between the numbers reported in the Italian real estate and those of the main European markets. The data speak clearly: the transactions in Europe will be over 10% by the end of the year, thanks to the excellent results of France, Germany, and Great Britain. For instance, the value of transacted properties in Paris (residential and non-residential) is meant to reach 175 billion euro. German transactions will reach 240 billion euro (+10.5%). The British market is not stopping either. Despite Brexit, real estate transactions are expected to rise to 125 billion euro (+8.7%) and 134 billion next year. What about Italy?

During the 26th edition of the 2019 European Outlook Forum in Santa Margherita Ligure, Mario Breglia, Scenari Immobiliari president, explained: “Real estate has registered positive results so far, although investors and families have been more cautious compared to 2017. The uncertainty around the fiscal and occupational policies of the new Government impacts the perspectives. The market suffers from the shortage of new high-quality products. If we exclude Milan, property prices have not risen, and it looks like they won’t rise in the next year either”. Narrowing down the analysis to residential, properties, the report by Scenari shows a general situation throughout Europe. “House transactions are in a very positive phase in all the main EU countries, with an average increase of 8% till the end of 2018, after the 11% recorded in 2017”, explained the analysts. Italy is no exception. According to the outlook, the turnover of the residential market will increase by 5% this year, surpassing 93 billion euro, and it will reach 97.4 billion next year (+4.6%). It will be possible thanks to the increased interest from institutional investors for residential as an asset class. Breglia continues, “there aren’t many opportunities for institutional investors to grow their investments in the international market. This lack of offer in comparison with the demand will be one of the main determining factors for the future trends of the residential market. The forecasts say that the investments in the European residential market will surpass 50 billion euro by the end of the year”.

The latest Tecnocasa report regarding the last six months of the year also confirms the positive trend of the Italian property market. “The Italian market is exiting from the recession, except some areas”, warns Fabiana Megliola, head of the Tecnocasa research centre. In her opinion, the biggest driver for the recovery is the credit market, thanks to the convenient interest rates and the more accessible loans, along with the low prices of properties registered in 2017. Megliola adds: “the demand has increased, and the offer will continue reducing, especially in the big cities. Moreover, the times to sell a property will decrease further”.

Source: Milano Finanza

Translator: Cristina Ambrosi

Portugal

Portugal  Spain

Spain  Greece

Greece